Robotic process automation insurance is becoming an indispensable tool for insurers looking to streamline operations and better meet customer expectations in the digital landscape. Digital is growing rapidly. Historically, the insurance industry has struggled with sluggish premium growth and escalating loss costs. Now, technological advances are requiring a shift to results-oriented operations, posing a challenge for insurers that may not be equipped for this shift.

Barriers to successful digitalization for insurers often include accumulated legacy systems, complex business models, lack of clear technology vision, and the isolating effects of siled organizations. To overcome these barriers, insurers, agents, and brokers are increasingly using RPA. The industry is full of time-consuming manual processes such as data entry, report generation, and interactions with legacy applications (such as Life Asia) that cannot be integrated. These tasks are where errors can occur, lead times are slow and customer relationships are ultimately hindered.

As noted by McKinsey and Company, the insurance industry has the potential to automate a significant 25% of its processes by 2025. By strategically implementing RPA use cases in insurance, carriers, and agents can achieve significant operational efficiency gains, open new avenues for innovation, and deliver exceptionally empathetic customer experiences.

Let’s explore more details about the benefits and use cases of robotic process automation insurance!

What is Robotic Process Automation Insurance?

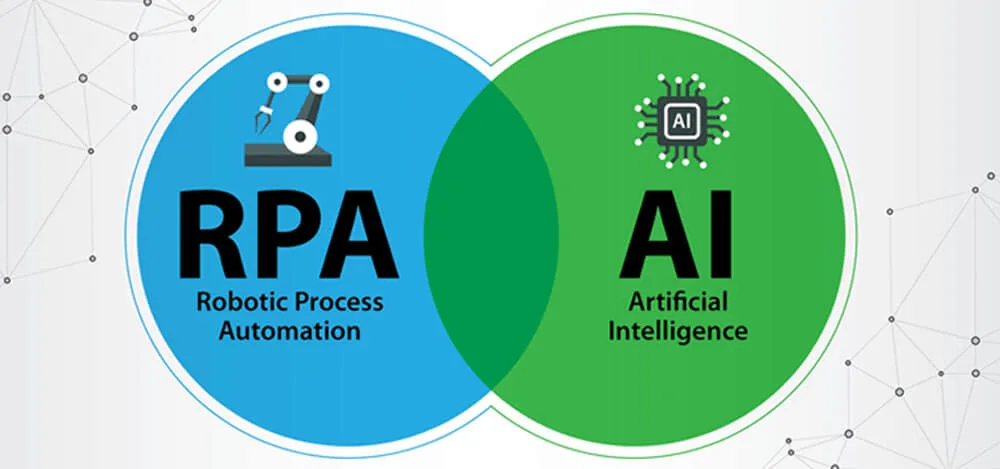

Robotic process automation (RPA) is finding a strong foothold in the insurance industry. Robotic process automation insurance leverages bots and AI to automate repetitive tasks, sometimes even eliminating them entirely. RPA also augments and extends the capabilities of human workers, leading to enhanced decision-making and processes.

RPA software bots offer far more than simply streamlining manual data entry. They can be configured and trained to tackle a broad spectrum of cognitive activities, including complex decision-making processes. Within insurance, RPA is gaining significant traction in areas like underwriting, claims processing, and in-depth analytics. The ability of bots to dramatically improve operational efficiency and slash costs is driving the rapid adoption of RPA in the insurance sector.

The benefits robotic process automation brings to the insurance industry

Adopting robotic process automation insurance can transform all aspects of your business. This technology streamlines operations, cuts costs, and enhances customer experiences. By embracing RPA, you’ll gain a significant competitive advantage in the market.

Improved Efficiency

RPA bots offer the tireless advantage of round-the-clock operation, handling clerical tasks at speeds far exceeding human capabilities. RPA-based insurance automation can result in a remarkable 5x speed increase when performing key activities.

Savings

The increased speed of insurance operations enabled by RPA translates directly into substantial cost savings. UiPath’s case studies illustrate this point – one insurance company, after deploying RPA bots to automate workflows, saved 18,000 person-hours and approximately £140,000 within just six months.

Superior Accuracy

Traditional manual processes within the insurance industry are inherently susceptible to errors, particularly when handling data from diverse sources and formats. RPA bots offer a solution that provides superior accuracy compared to human operators. This precision minimizes errors and leads to better outcomes for your insurance business.

Enhanced Regulatory Compliance

In the highly regulated insurance industry, accurate task execution is crucial for regulatory compliance. Robotic process automation insurance bots, with their near-perfect accuracy, become invaluable tools for administrators and accountants. They help ensure compliance standards are met, minimizing the risk of costly errors or penalties.

Easy Integration

RPA bots offer a seamless and cost-effective solution for insurance companies. Their non-invasive nature allows them to integrate easily with existing legacy systems, eliminating the need for expensive overhauls. This means automating insurance processes becomes much simpler and less disruptive.

Better Scalability

Robotic process automation insurance bots offer insurance companies superior scalability compared to human teams. They can be quickly and cost-effectively deployed when workloads increase. This grants insurance companies greater flexibility to seize new opportunities or rapidly adapt to rising demand.

Improved Customer Experience

Insurers routinely handle stressful customer interactions following unfortunate events. In these situations, RPA bots streamline paperwork and processes. This efficiency translates directly into an improved customer experience during difficult times, enhancing customer satisfaction and trust.

15 Use Cases of RPA in Insurance Field

Here are 15 use cases for robotic process automation insurance in the Insurance Industry. Let’s find out!

1. Compatibility with Legacy Systems & Applications

Many established insurance providers heavily depend on legacy applications for core business operations. This reliance can create challenges that newer, tech-centric insurtech companies don’t face. Legacy systems often struggle to communicate effectively with each other, requiring manual intervention from employees to bridge the gaps. Additionally, integrating new ERP or BPM solutions with older legacy systems can be a complex and time-consuming process.

Robotic process automation insurance offers a solution to bridge the divide between legacy systems, enhancing both customer experiences and back-office efficiency. Its ability to integrate seamlessly into existing workflows streamlines processes. Furthermore, RPA’s adaptability ensures compatibility across all system types, regardless of how old they may be.

2. Claims Processing

RPA breaks down the information silos created by legacy applications. It allows you to consolidate claims processing data from disparate sources, giving you a comprehensive view. Additionally, RPA automates numerous manual claims processes such as data extraction and input, intricate error tracking, claims verification, and even the detection of fraudulent claims.

The result? Your employees save countless hours previously spent manually searching for information across systems. Your customers benefit from faster, more efficient service, leading to a significantly improved overall customer experience.

3. Underwriting

Similar to claims processing, insurance underwriting involves extensive information gathering from various sources. RPA simplifies this by automating data collection from both internal and external systems. This significantly reduces the workload for your underwriters.

RPA further assists underwriters by streamlining risk analysis and evaluation. It can efficiently populate internal systems with relevant data, saving time and effort. Additionally, RPA can be used to generate reports with recommendations while analyzing loss runs, further aiding the underwriting process.

4. Regulatory Compliance

RPA plays a crucial role in minimizing the risk of regulatory breaches within the insurance industry. With ever-evolving guidelines for audit trails and documentation, coupled with the error-prone nature of manual processes, maintaining compliance can be a major challenge. RPA mitigates this by automating processes, guaranteeing accuracy, and meticulously logging all changes according to your set rules.

Beyond data accuracy and logging, RPA can automate various compliance-related tasks:

- Compliance report generation: RPA creates detailed reports for easy auditing.

- Customer data validations and client research: This ensures information accuracy.

- Data security operations: RPA safeguards sensitive data.

- Delivery of account closure processing notifications: Streamlines communication and maintains records.

5. Policy Administration & Servicing

Traditional policy administration software systems can be costly and difficult to maintain. Their scalability limitations can also hinder your business growth as your customer base expands. RPA offers a solution by simplifying operations for your employees, eliminating the need for time-consuming navigation across multiple applications.

RPA achieves this by automating transactional and administrative aspects of processes within areas like settlements, tax management, risk capture, accounting, regulatory compliance, and credit control. This streamlining results in significant time savings and increased efficiency.

6. Form Registration

Form registration, while necessary, can be a tedious and time-consuming process within insurance operations. RPA offers a powerful solution, automating the entire process and completing it in a mere 40% of the time it previously took. Even more impressive, this can be achieved with roughly half the staff previously required.

7. Policy Cancellation

Policy cancellations can be a frustratingly slow and cumbersome process when handled manually. It involves navigating between numerous systems like email, CRMs, Excel, policy administration tools, and PDFs. Robotic process automation insurance revolutionizes this by seamlessly switching between these various interactions, handling them all simultaneously.

As a result, organizations implementing RPA often see policy cancellation times reduced to a mere third of what they were before.

8. Sales and Distribution

Sales and distribution within insurance can be a complex and demanding area. The heavy reliance on manual processes makes it prone to errors, and policy administration systems can be costly to maintain.

RPA offers a transformative solution by automating several crucial tasks within sales and distribution:

- Legal and Credit Checks: Ensures accuracy and efficiency.

- Compliance Procedures: Maintains adherence to regulations.

- Sales Scorecards and Agent Notifications: Streamlines communication and performance tracking.

RPA’s error-free execution and speed benefit both your business and your customers. Customers receive the swift service they demand, while your employees gain valuable time to focus on higher-value tasks.

9. Finance and Accounts

RPA excels at automating repetitive tasks such as button presses, clicks, keystrokes, copy/pasting, and template filling. This precision makes it invaluable across various insurance use cases, especially within finance and accounting.

For instance, RPA bots can significantly streamline daily bank reconciliations, minimizing errors and reducing labor demands. Additionally, they can optimize policy-related costs and reduce overall transactional expenses, boosting your bottom line.

10. Process & Business Analytics

Providing an exceptional customer experience is a top priority in insurance. A key strategy for achieving this is continuous measurement and analysis of your processes. RPA makes this possible; its detailed audit trails record every action a bot takes, replacing the ambiguity of traditional paper-based processes.

RPA’s audit trails serve a dual purpose. They ensure regulatory compliance and provide the granular data needed to identify areas for process improvement. This data-driven approach allows you to continually refine your operations, ultimately resulting in a superior customer experience.

11. Data Entry Processes

Manual data entry is a pervasive reality in the insurance industry, encompassing tasks from claims to quotations. RPA offers a solution that automates these routine and time-consuming processes. This frees up your skilled employees to focus on higher-value work.

Beyond saving time, robotic process automation insurance significantly increases speed in data entry tasks. Most importantly, it eliminates the human errors and inconsistencies that inevitably plague manual data processing.

12. Influence on Scalability

RPA offers unparalleled scalability. Insurance companies can easily add or remove bots, and adjust their tasks as needed. This flexibility is crucial in an industry known for its regulations and often slow pace of change.

While the insurance sector itself may move slowly, customers are demanding faster, more responsive service than ever before. RPA empowers insurance companies to meet these expectations. Its scalability allows quick adjustments to handle fluctuations in workload, ensuring timely service and preventing customer frustration. This adaptability is essential for staying competitive in today’s market.

13. Product & Service Innovation

RPA plays a vital role in supporting the launch of new insurance services and products. It streamlines the development of customer portals, apps, and on-demand quote systems. Additionally, RPA bots can act as powerful “assistants” to your customer support team.

Consider the scenario of an attended bot used by an agent to address service requests in real time. This virtual assistant rapidly retrieves all necessary customer data, allowing the agent to provide faster and more efficient support. This seamless integration of RPA directly enhances the customer experience.

14. Responding to Queries

Facing a large volume of customer queries? RPA provides a solution for faster response times. RPA bots can skillfully analyze incoming emails and take appropriate actions. For simple, common queries, the bot can provide immediate resolutions using your pre-defined answers. If a query requires more complexity, the bot seamlessly redirects it to a human employee for further assistance.

15. Customer Experiences

Customer experience is the key differentiator for businesses. Your customers demand exceptional service, and RPA can help you deliver. Across its various applications, RPA leads to happier customers by:

- Faster service: Streamlined back-office operations eliminate unnecessary delays.

- Fewer errors: RPA’s accuracy minimizes time-consuming fixes.

- Increased agent availability: Freed from repetitive tasks, agents can focus on providing personalized support.

- Fewer delays: Efficient processes significantly reduce wait times.

- Personalized and convenient experiences: RPA enables features like self-service portals and on-demand quotes.

- Decreased back-and-forth: Proactive information gathering minimizes frustrating communication loops.

RPA CLOUD is a solution

You don’t know which tool to choose to help you automate and simplify your work related to insurance. If you are wondering why not try RPA CLOUD, this is a great Robotic Process Automation Insurance for you and your business.

RPA CLOUD is cloud-based software robotics. To be suitable for all users, RPA CLOUD offers an extremely user-friendly interface. You don’t need to have programming knowledge to use it.

One of the outstanding advantages of the software is its cross-platform support. With RPA CLOUD, you can work on many popular platforms such as Google Chrome, Excel, Gmail, Google Spreadsheets, Google Drive, Google Calendar, Google Docs, AWS S3, and FileMaker.

RPA CLOUD is a great support tool that helps you complete repetitive tasks in the insurance field quickly and accurately. From there, this software helps improve efficiency, save time, costs and increase customer satisfaction for businesses.

The insurance market is competitive and demands constant innovation. To stay ahead, insurers must adapt and embrace change. RPA is a powerful tool that can transform your operations, streamline processes, and seamlessly integrate even outdated legacy systems. This newfound efficiency empowers you to deliver the swift, personalized, and compassionate service that modern customers expect.

If you are looking for Robotic Process Automation Insurance for your business, then try RPA CLOUD now.

Read more: