Are you an accountant or an employee working in the accounting field? Are you interested in researching Robotic Process Automation Accounting?

Accounting has always been known as a field that requires precision and accuracy. Robotic process automation (RPA) completely transforms the way accounting tasks are performed with greater efficiency, consistency, and lower errors. Robotic process automation in accounting includes automating tasks such as data entry, reconciliation, report generation, and financial analysis.

In essence, robotic accounting is the application of RPA technology to automate repetitive, rules-based tasks in accounting work. Software robots, also known as ‘bots’, are programmed to complete boring and time-consuming tasks for humans.

This practical guide will explore the importance of Robotic process automation accounting. We’ll cover the benefits of RPA and discuss the best strategies for integrating robotics into your accounting operations.

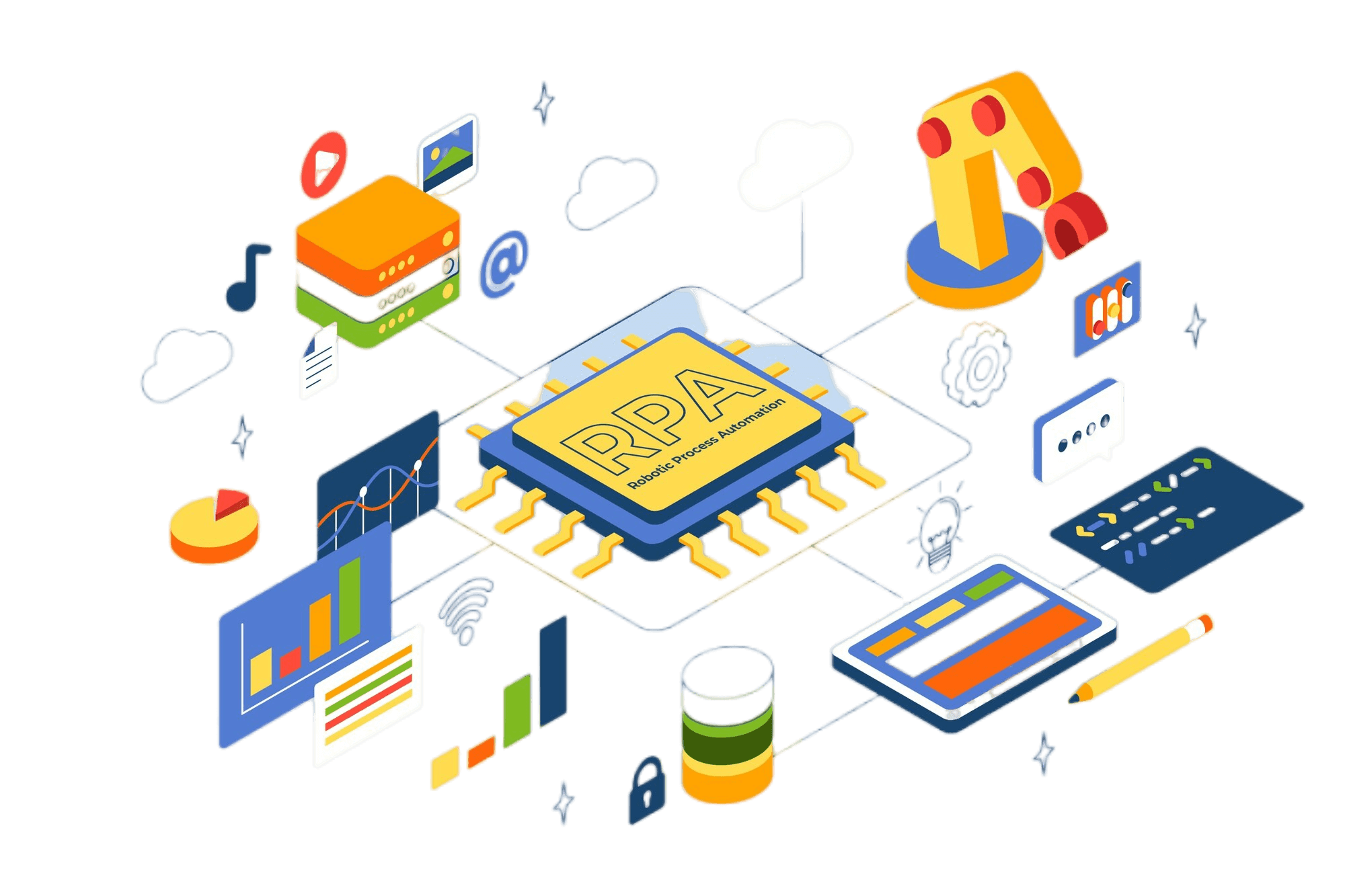

Robotic process automation (RPA) is a powerful technology that streamlines business processes. It uses software robots, or ‘bots’, to automate routine tasks normally performed by humans. These bots are carefully programmed to follow precise rules and procedures, allowing them to interact with digital systems just like users.

Here are some key features that make RPA valuable:

- Rules-based Execution: Bots meticulously follow predefined rules and instructions, ensuring consistent and accurate task completion.

- System Flexibility: RPA interacts seamlessly with any software or system, reflecting user actions.

- Non-invasive Integration: RPA works without disrupting existing systems or infrastructure, making deployments smooth.

- Speed and Precision: Bots work quickly and with high precision, minimizing errors and increasing overall productivity.

How Does Robotic Process Automation Accounting Work?

Robotic process automation accounting is like having a tireless digital assistant for your financial tasks. It uses software bots that can automate those time-consuming, repetitive processes. Think of it like a super powerful Excel macro that can work across all your accounting systems, making everything faster and more accurate.

If you’ve ever used scripts to automate tasks in Excel, then you already have a basic understanding of how robotic accounting works – but RPA takes it to the next level!

With robotic accounting, software bots (or ‘bots’) are the new members of your team. They can handle everything from data entry and accounts payable management to running audit tests and generating detailed financial reports. Just like your Excel scripts follow the rules, bots do the same. But they can work on many different software systems and handle complex tasks much faster than humans can.

Here’s how robotic accounting works in practice:

- Step 1: Find the Right Tasks: Look for those repetitive, rules-based jobs that take up tons of time. Things that don’t need a lot of complex judgment calls are perfect for automation.

- Step 2: Teach Your Bots: This is where you program the bots with all the rules and steps to get the job done.

- Step 3: Let the Bots Work: Your bots get to work, clicking, typing, and pulling data just like a human would – only faster!

- Step 4: Keep an Eye on Things: Just like any good team, you’ll want to check in on your bots to make sure they’re running smoothly and might need occasional updates.

Use Cases of Robotic Process Automation Accounting

Large companies have to process mountains of financial records every month. Accounting teams spend countless hours searching for documents, scanning them, checking digital copies, and entering all that data manually. RPA can streamline the entire process and eliminate those annoying human errors that slow things down.

The best part is that RPA is extremely useful in a variety of accounting tasks.

Let’s explore examples of robotic process automation accounting!

Invoice Processing

Dealing with invoices needs to be fast, accurate, and reliable – that’s tough to do by hand! Without automation, invoices processing can slow down your whole accounts payable process. RPA changes the game by automating every step of invoice handling, from receiving and checking them to making payments.

It can even use special tech called Optical Character Recognition (OCR) to pull data from different sources, match up invoices with purchase orders, and alert you if things don’t match. Approved invoices are then automatically sent to the right team members, and reminders are set up.

Automating accounts payable with RPA is a great way to improve your Days Payable Outstanding (DPO) by speeding up vendor checks, purchase order entry, payment matching, and making sure expenses follow the rules.

Accounts Receivable

Managing accounts receivable (all that money owed to your company) can be tricky. It needs both accuracy and speed to improve your Days Sales Outstanding (DSO). However, mistakes happen, and things get delayed because it relies on both your customers and your internal systems.

RPA can make a huge difference by automating many parts of the process, such as setting up customer information, gathering data, creating quotes, and generating and sending invoices. Advanced RPA solutions can even help improve cash flow and get rid of delays by pulling data from various sources and updating your systems automatically – saving your accountants the hassle of juggling multiple systems.

Expense Reporting

Every company has expenses, and tracking them all is key to good bookkeeping and managing finances. But it’s a slow and expensive process when done by hand. In fact, it costs about $27 to manually create a single expense report. Automation cuts that cost down to just $5 per report! RPA can automate expense reporting, making things easier for everyone.

Advanced RPA bots can gather expense data, attach receipts to the correct entries in your system, and even check for errors or violations of company policies. Automating expense reports with RPA helps get rid of mistakes, makes things easier for your employees, and ensures your company follows all the rules.

Payroll Management

Payroll can be a major headache! It involves tons of time-consuming tasks like pulling data, checking timesheets, scheduling payments, and figuring out all those deductions and bonuses. Plus, your team has to double-check employee information, such as sick days and expenses.

To avoid delays and costly mistakes, try using RPA to automate payroll management. Advanced RPA bots can grab data from different systems, calculate deductions and bonuses perfectly, and even make sure everything follows tax rules.

Financial Reporting

Businesses need to track their profits and losses carefully to stay on top of their finances. As an accounting professional, you know how much work it takes to update P&L reports by hand. RPA can change all of that by automating this time-consuming process and giving you accurate, real-time financial reports.

RPA bots can create balance sheets, income statements, and even handle complex analysis. They can also improve financial planning by using past data and information from important documents. Automating your financial reporting with RPA makes everything more transparent and accurate.

Intercompany Reconciliations

Intercompany reconciliation (ICR) is vital for accurate financial statements, ensuring everything balances out. But it can be a real-time sink, with lots of data entry and cross-checking. RPA can automate ICR, saving time and increasing accuracy.

RPA bots can pull transaction data, approve matches, and let you know if things don’t add up. They streamline the whole process: finding the right data, comparing statements, contacting customers, and even creating journal entries.

Tax Compliance

Big companies that operate across different locations have to follow a ton of complex state and federal tax rules. RPA can help you avoid costly mistakes by working with your tax software to keep things in order.

RPA bots can gather tax liability data, create records, update tax return files, and even prepare and submit tax reports to the right authorities. Automating these tasks saves time and helps you avoid legal trouble down the road.

Inventory Management

Inventory accounting, which tracks stock levels and updates financial records, needs to be accurate – and that’s where RPA comes in! RPA bots can make a huge difference by monitoring stock levels, predicting what you’ll need, sending alerts when things get low, and even placing orders. They can also automate the accounting side, pulling data and updating financial records.

With RPA, e-commerce and brick-and-mortar stores can improve wait times for customers, avoid running out of stock, and save money on storage space.

Benefits of Robotic Process Automation in Accounting

We all get bogged down with those repetitive accounting tasks – updating spreadsheets, processing invoices, and generating endless reports. Robotic process automation accounting can take those chores off your hands, freeing you up for the fun stuff! It’s definitely an accounting best practice to check out.

Here’s why robotic accounting is awesome:

- Save Money: RPA cuts down on labor costs big time. Bots can handle tasks like invoices and payroll, so your team can focus on more important (and interesting!) things. You’ll save money by needing fewer people and avoiding costly mistakes.

- Boost Accuracy: Repetitive tasks are boring, so it’s easy to make mistakes. Bots don’t get tired or distracted. They follow your rules to the letter, making sure the data is accurate and reliable.

- Supercharge Productivity: Imagine never having to manually update a spreadsheet again! With bots on the job, your team can work on higher-level tasks, boosting productivity across the board.

- Stay Compliant: Bots are great at following rules. You can program them to keep records updated and compliant with all the regulations your company needs to follow.

Security Upgrade: Bots can be programmed with strict security protocols to protect sensitive data. Think of them as super-secure filing cabinets! - Grow without Growing Pains: Business booming? Bots can easily be scaled up or down to handle anything you throw at them without sacrificing speed or accuracy.

- The Night Shift is Now Open: Bots don’t need sleep! They can work 24/7, tackling tasks outside of office hours. This means things get done faster, and your workload gets lighter.

What Are the Challenges?

Just like your robot vacuum occasionally gets stuck, there are challenges to bringing robotic process automation accounting into your business. It doesn’t mean RPA isn’t a good idea; it requires planning!

Here are some difficulties you might encounter:

- Tech Issues: Even the best tech has hiccups. If something goes wonky, like a software login timing out, your bot might not work until a human fixes the problem.

- Complex Tasks: RPA excels at repetitive tasks with clear rules. Complex tasks that need judgment calls or decision-making are better left to humans (for now!). Think of a bot being able to process an invoice but flagging strange charges for a human to review.

- Reliance on Old Systems: Bots are built to work with your existing software. Big changes to those programs mean you might need to update your bots as well.

- Security Worries: While you can program bots to be super secure, there’s always the potential for a hack or a programming error that could cause a data breach.

- Absence of Human Touch: Robots are efficient, but customer service, complex decisions, and those nuanced situations often need a human’s understanding and empathy.

- Staff Might Be Resistant: Change can be scary! Not everyone will be excited about bots, especially if they worry about job security. Clear communication and training are essential.

- Not Enough Connects: Bots can be programmed to work with many systems, but not everything will be compatible right away. This might lead to some manual work in the beginning.

Robotic Process Automation Accounting with RPA CLOUD

Are you learning about robotic process automation for accounting? If you haven’t found the right RPA to complete accounting-related tasks for you and your employees, then RPA CLOUD is a great choice for you.

RPA CLOUD is a cloud-based software robot with an extremely user-friendly interface, making it easy for users to get their work done easily and quickly. This software not only helps users automate repetitive tasks in many different fields, including accounting.

RPA CLOUD is known for its outstanding advantage of multi-platform support. It allows you to work on many popular platforms, such as Google Chrome, Excel, Gmail, Google Spreadsheets, Google Drive, Google Calendar, Google Docs, AWS S3, and FileMaker. From there, it can help you complete accounting tasks quickly and accurately.

RPA is a powerful tool that is changing the way businesses operate. If you’re in a leadership position, consider using RPA to revolutionize tasks like processing invoices, handling expense reports, managing payroll, and even financial forecasting. The benefits are huge: reduced costs, fewer errors, boosted productivity, and easier compliance with regulations.

To make the most of Robotic Process Automation Accounting, it’s important to follow proven implementation strategies. These will help you get your project off the ground smoothly and maximize the returns on your investment.

Not sure where to start with automation and digitizing your company’s workflow? We’re here to help! Take advantage of our free 30-minute consultation. Our consultants will suggest RPA Cloud for your business, outlining which technologies will deliver the biggest benefits for streamlining your processes.

Read more: