Is a lot of your company’s money disappearing for no apparent reason? It may be due to “Tail spend“, which occurs due to multiple low-value purchases from many different suppliers over a period of time. So how to do Retail tail spend optimization?

Each small purchase may not seem like much, but they can add up to a significant deficit. And luckily, Tail spend management can help you and your retailers control this problem.

Tools can give you the visibility, control and automation you need to improve this area of spending. You can save, control your cash flow, and make your purchasing process smoother.

This article will discuss the definition of tail spend management and four best Retail tail spend optimization tools that you can choose from.

Let’s explore!

What is the Tail Spend?

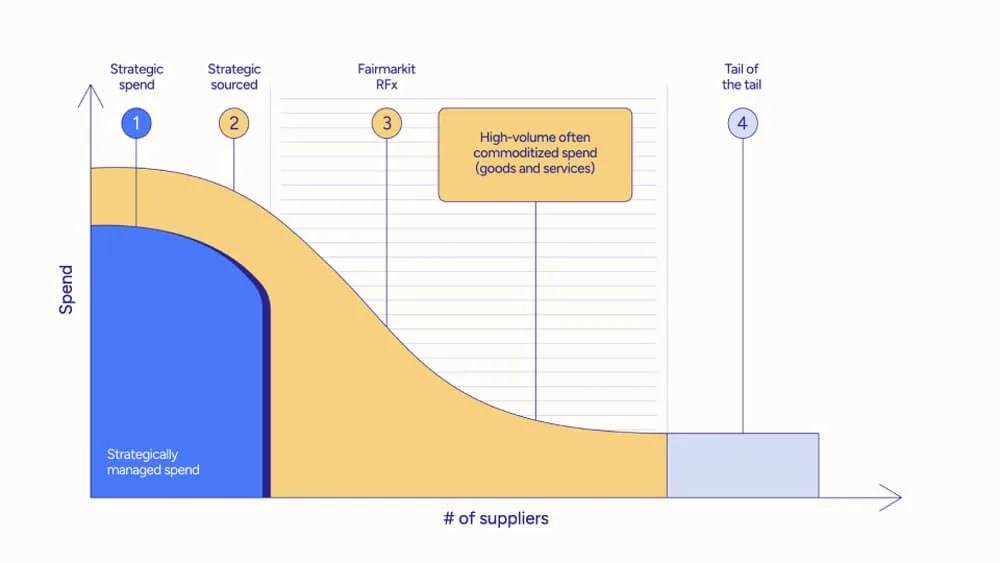

Tail spend refers to what your company spends over a year on many small purchases from many different suppliers. The special thing about a business’s total spending is that tail spending usually accounts for about 80% of purchases but only accounts for 20% of total spending.

The following are some characteristics of tail spending:

- Large quantity, small value: Many individual purchases, each with low value.

- Distributed: Purchases take place across many different departments and often bypass the regular purchasing process.

- Difficult to categorize: Tail spending often involves many different goods, making it difficult to track.

- Difficult to see: Due to being dispersed, it is difficult for the purchasing team to monitor and control everything.

Even though each purchase is small, tail spending can be inefficient and lead to missed savings. Tail spend management helps you see and control these purchases, saving you money and making purchases easier.

What is Tail Spend Management?

Tail spend management is a way to control the often overlooked small purchases your company makes. Use strategies, tools and processes to better view, control and manage all your small purchases from many different suppliers.

The following are the key elements in Tail spend management:

- Visibility: First check where all these small purchases are going. You need to use data to understand spending patterns, supplier trends, and ways to optimize costs.

- Control: Once you can see where the money is going, you can begin to control it. This means you need to make a list of preferred suppliers who offer better prices than other suppliers or automate the purchasing process for frequent items.

- Efficiency: By simplifying the purchasing process for these small transactions, your purchasing staff can focus on larger, more important projects. Achieving this requires using online portals where people can make their own purchases or automating approvals.

- Save money: The ultimate goal of managing end-of-period expenses is to save money. This is achieved by preventing unauthorized purchases, getting better prices and using fewer suppliers.

4 Retail Tail Spend Optimization Tools

Below are the top 4 tools that can help you in Retail tail spend optimization.

Coupa

Coupa is the leading online platform that helps businesses manage spending, including solving tail spend problems.

This system can organize all your spending data, help you see spending patterns, track supplier performance and find ways to save money on your bottom line. .

Coupa can also automate purchasing for small purchases, such as allowing employees to self-order approved items or automatically approving repeat orders.

If the company has a large supplier network, it also helps manage many of your end-spend suppliers. This makes it easier for you to work with them and comply with your company’s purchasing rules.

Pros:

- Powerful data analytics tools to understand your bottom line spend.

- Automate purchases for small purchases.

- Automate supplier setup and tracking.

- Connect to other tools you may use.

Cons:

- Setting up takes time and effort.

- Can be expensive, especially for smaller companies.

- Customization may take some learning.

Price:

Coupa offers four paid plans and one free plan:

- Registered: Free

- Verified: $549/year

- Premium support: $499/year

- Advanced: $4,800/year

Procurify

Procurify is a cloud-based platform that helps manage the entire purchasing process, including small, frequent purchases called tail spends.

Procurify can automate many of the manual tasks involved in end-of-spend purchases, thereby allowing your purchasing team to spend more time and focus on bigger projects.

It also allows employees to order approved items themselves through online portals, making it easier for everyone to purchase.

Plus, it has tools to help categorize spending so you can identify trends, check supplier performance, and make smart decisions to save money.

Pros:

- Automate tasks like ordering, approving, and creating purchase orders for small purchases.

- Helps categorize spending to make smart decisions.

- Make it easy to add new suppliers and find ways to use fewer suppliers.

- Easy to use for everyone.

Cons:

- It doesn’t have as many customization options as some other tools.

- It may not be best suited to very complex end-spending needs.

- The reporting features are not as detailed as some other solutions.

Price: You need to contact their sales team for pricing information.

Zycus

Zycus is a leading company that produces software for purchasing, including a full suite of tools for online purchasing.

The company uses AI to automatically sort spending data from small purchases, saving time and ensuring everything is categorized correctly. This helps you see spending patterns and find ways to save money.

Zycus has a special feature called “Autonomous Quick Source” that makes it easy to buy cheap, popular items. This feature helps purchasing teams save a lot of time and effort.

Their “Merlin” tools use AI to assist with final spending. “Merlin for Contracts” helps find contract problems, and “Merlin for Risk” helps you understand your multi-vendor risks.

Pros:

- Special feature to automate purchases of common small items.

- Makes it easier to process invoices for small purchases.

- Works for international businesses and different currencies.

- Customizable to fit complex needs.

Cons:

- Additional training is required to learn how to use all features.

- The home screen can be difficult to navigate.

- Can be difficult to learn, especially for new users.

Price: You need to contact Zycus to get a quote based on your needs.

Brex

Brex offers business cards with spending limits and real-time tracking, so employees can make approved purchases while staying within budget.

It also automates tasks like expense reporting and approvals, helping employees and finance teams save time.

Brex connects to popular accounting software, automatically organizing expenses and matching them to transactions. This helps financial processes run more smoothly and accurately.

Pros:

- Business cards with real-time tracking and spending controls.

- Expense reports and automated approvals.

- Lets you create virtual cards with spending limits for specific purchases.

- Connects to popular accounting software.

Cons:

- It mainly focuses on business card uses, which may not be suitable for all small purchases.

- Reporting features may not be as detailed as some other tools.

- Connecting it to your existing purchasing system may require additional effort.

Price:

- Essentials: Free

- Premium: $12/user/month

- Enterprise: Contact Brex for pricing

Conclusion

Tail spending can really affect your company’s bottom line. With good management, you can control, improve processes and find hidden savings.

The best Retail tail spend optimization tools for you will depend on your needs. Think about the number of small purchases you make, their complexity, the level of automation you want, your budget, and the needs of your staff.