Robotic Process Automation (RPA) For Finance

Breakthrough Digital Transformation

According to the Global RPA Survey about Robotic Process Automation for Finance, showed 93% of banks deployed RPA software will continue to increase investment & digitally transform their businesses in the next three years.

- – 98% of tasks are automated by robots

- – 95% faster reconciliation times

- – 2.5x faster transaction processing

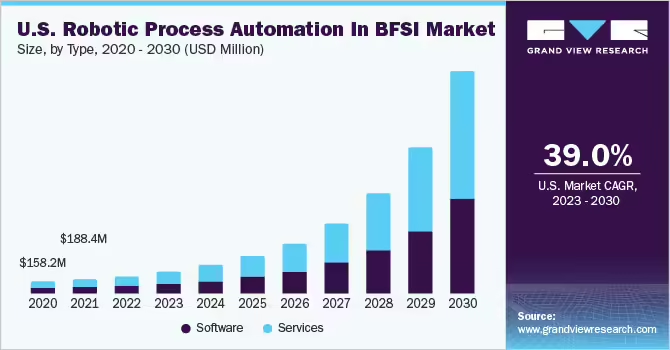

The chart shows that along with the development of the service, Robotic Process Automation RPA in Finance’s incredible growth rate will be seen in the future.

Why are 93 % of banks around the world now applying RPA solutions?

When the human workforce is limited and interrupted, it is easily affected by external factors such as mental health, emotions, and external relationships, these factors can all directly lead to instability in the operations of the finance & accounting industry. But contrary to that, Robotic Process Automation for Finance working 24/7 continuity and high accuracy are the deciding factors in digital transformation for the Finance industry.

Highest digital conversion

The best thing about Robotic process automation RPA in Finance is that you will see a return on investment almost immediately, once RPA software is implemented

High ROI

With a small initial investment cost, RPA automates transactions and invoices continuously 24/7, thereby improving work efficiency and increasing ROI immediately

Reduce errors

Shows 85% reduction in significant errors from human manual operations

Reduce pressure & dependence on the human workforce

A McKinsey case study showed that after unlocking the full power of RPA, the month-end closing processes lasted two days instead of two weeks.

Working 24/7, Ensure continuous transactions

Works continuously refreshed and updated, regardless of day or night, holidays or weekends

Accuracy

Banks applying Automation Software RPA have reduced >92% of unnecessary errors.

Security

Ensures 100% secures customer and system information

Benefits of Robotic Process Automation RPA for Finance

What is Robotic Finance?

Robotic Finance will simulate the manual operations of an accountant, be set up to access the financial system, analyze data based on history and evaluation, link data systems, and make predetermined financial reports. without any human intervention, all processes are automated by bots

1.

TOP 1 digital transformation

According to Deloitte, 82% of experts plan to improve digital transformation through Robotic process automation for Finance. RPA is the foundation and first step to digitally transform businesses. With small costs and high returns, RPA solutions are easy to deploy and show immediate ROI

2.

The ability of extension

When transaction and invoice processing volumes reach business peak, any impact on the human workforce can lead to stagnation or even paralysis of the entire system. But in contrast to virtual accounting RPA, as workload increases, bots’ output can scale according to demand.

3.

Innovation

Extract old and new data from existing systems, automate data analysis, and provide in-depth insights for humans to come up with the best business strategy

4.

Financial forecast

Collect financial data from a variety of systems such as ERP, CRM, and accounting systems. Integrating AI, RPA can be configured to update and adjust forecasting models in real time when there are changes in the financial markets or the data collected

Successful Applications

1. Accounts Receivable

- Automate the invoicing process:

Automate customer information management, fill in customer information into invoices, and automatically send electronic invoices to customers promptly.

- Payment tracking and reminders:

Access the system to monitor customer payment status and update accurate payment information. Can be set up and adjust the time and frequency of orders, remind customers to pay automatically, help increase debt collection rates, and minimize overdue debt.

- Processing payments:

RPA software automatically records payments from customers and manages payment disputes by collecting and analyzing various data, ensuring accuracy and completeness.

- Analysis and reporting:

Report the status of periodic receivables according to the owner’s settings, and analyze and continuously update receivables data to identify potential problems such as customers frequently paying late, That suggests corrective measures.

- Bad debt management:

Automatically access data to monitor and analyze settlement schedules and analyze debt status and trends, helping banks plan timely debt collection processing.

2. Accounts Payable and Procure to Pay

More efficient, reduce costs, minimize errors, establish supplier relationships

DPO is the primary concern that needs to be tightened. RPA tools in finance improve DPO by speeding up invoice processing, building a faster-integrated supplier experience conversion process.

Manages DPO by establishing good relationships with suppliers and optimizing cash flow.

RPA solution will automatically enter information, helping accountants not have to deal with huge information systems

3. Financial Reporting

Accurate, prompt and effective forecast

Automatically generate reports periodically (daily, weekly, monthly) according to the users, helps reduce errors and save time effectively Robotic Process Automation RPA in Finance will access data, monitor and analyze historical loan and cash flow data, and thereby provide accurate forecasts to help banks handle problems promptly and effectively.

4. Inventory Management

Accurate, prompt and effective forecast

– Daily inventory reports: Generates and sends daily inventory reports to finance and management, helping to quickly and accurately track current inventory quantities and fluctuations.

– Manage supplier payments: Processes invoices from suppliers, creates payment requests, and updates the accounting system when payments are made.

– Merchandise demand forecasting: Analyzes historical sales data to forecast merchandise demand and create ordering plans, helping to maintain optimal inventory levels and avoid shortages.

5. Treasury

Optimize, accurate, minimizing risks

– Manage treasury processes and procedures: Robotic Process Automation RPA for Finance not only handles your company’s cash flow and financial assets but also ensures the company has enough liquidity to meet its financial obligations.

And transform complex processes into smarter ones to help establish scope, and reduce risk.

– Cash management: Monitors and analyzes cash flow, manages performance and forecasting, and deploys techniques and strategies. This ensures the System has enough cash to meet financial obligations.

– Manage internal bank accounts: Accesses and Monitors internal bank accounts, which improves visibility into your cash position and simplifies cash management activities.

– Debt and investment management: Effective treasury management, helps banks maximize liquidity and improve financial performance.

– Risk management and prevention strategies: Interest rates have a significant impact on your risk strategy and financial performance. By deploying AI technology and bots to monitor changes in interest rates, you’ll stay ahead of the game, minimizing risk.

6. Travel and expenses

Automate repetitive, time-consuming tasks

Robotic Process Automation RPA for Finance automatically accesses existing data systems to enter expense records and check against company policies and laws, compile data into expense reports, generate pay slips, and manage benefits and reimbursement pay.

Raise alerts in case of policy violations or data inconsistencies

7. Payroll

Accurate and optimize time

This is a time-consuming job for the accounting department. RPA for Finance will automatically extract employee data, verify data on information systems (sick days, business trips, timesheets), create and approve timesheets

8. Tax

Convenient and effective

RPA for Finance automatically collects data about tax obligations, bots will automatically create a tax base, extract information from a lot of data on the system to make reports, update tax declaration workbooks, and submit reports to tax authorities

Customer story successfully applied RPA

“I selected Robotic Process Automation with rapid scalability as well as high security and high accuracy, which is very important in the finance & tax”

Paul Barrett

Director of Taxopedia Limited

– Telecom company saves 100 FTE on outsourcing.

– Deloitte Brazil Reduces Management Preparation Time From 5 Days To 1 Hour.

– Boston Scientific saved 3,900 man-hours and reduced 85% processing time.

Conclusion

RPA software is the door to automation in finance. 93% of leading banks have been applying RPA to promote business digital transformation. RPA provides great financial automation solutions that work right out of the box and start delivering ROI almost immediately.

If you want to discuss specific use cases in finance departments and see how Robotic Process Automation for Finance is in action, schedule a demo.

We’re happy to help you estimate your ROI and provide any other consulting you’d like.